Get Started

Making Your Giving Plan

Charitable gifts are as individual as the people making the contributions. All share a passion for philanthropy, but choose to give in different ways.

Some want to name the fund they establish — others want to give in total anonymity. Some want to begin making grants immediately, others need income for the duration of their lives. Some want simply to give today.

Ways to Give

There are many ways to give through the Catholic Community Foundation (CCF). It is helpful to know that nearly all options result in the establishment of a fund — a legal giving instrument that preserves and governs your financial gifts. Consider whether you’d like to open a new fund or plan for a future fund.

Open a New Fund

Donor Advised Fund

A simple, flexible account that allows you to make gifts, receive immediate tax benefits, and then recommend grants whenever you want. Think of it as a charitable checking account.

Endowed Fund

A permanent fund that is invested and provides annual grants to your parish or favorite charity forever. An endowment fund helps you leave a faith-inspired legacy that is sure to last.

Donor Designated Fund

A streamlined fund that benefits a single beneficiary. You decide how much to grant and when. This is an option if you want to make a qualified charitable distribution (QCD) from your IRA.

Plan for a Future Fund

Bequest

A gift that establishes a fund upon your passing. This is most often done with simple language in your estate plan.

Charitable Life Insurance

The value of life insurance can initiate a charitable fund upon your passing either by transferring ownership of the policy to CCF or by naming CCF as a beneficiary.

Charitable Remainder Trust

A trust that allows you to make a significant charitable gift of highly appreciated assets and still receive an income. Upon the term completion, remaining assets form an endowment.

Support the Salt & Light Fund

Right Time. Right Place Right Need.

Contributors to this fund collaboratively support urgent and unmet needs in our community. Grantmaking from the Salt & Light Fund strives to preserve the good work of critical charities in our community and address emergent needs as they become illuminated — today and tomorrow.

What to Give

Get in Touch

We're Happy to Help

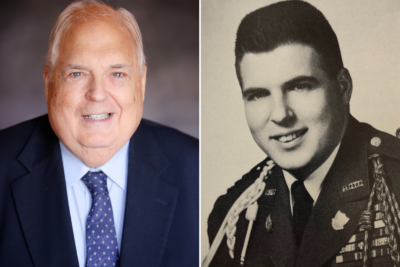

Christopher D. Nelson, J.D.

Executive Vice President of Development & Donor Engagement

651-389-0874

Email Christopher

Bethel M. Ruest, MBA

Senior Philanthropic Advisor

651-389-0875

Email Bethel

Liz Boo Neuberger, M.A.

Philanthropic Strategist

651-389-0883

Email Liz