Investing with a Catholic Heart

Faithful Stewards

We’re called to be good stewards of the blessings we’ve received. At CCF, we answer that call by investing the charitable assets of our faith community with a Catholic heart.

Faith-Consistent Investing

Aligning Money with Mission

CCF has long been guided by the USCCB’s Socially Responsible Investment Guidelines. These guidelines have inspired us and informed how we implement faith-aligned investment strategies. They’ve allowed us to remain true to our Catholic faith and fulfill our fiduciary duties to our partners and donors.

CCF’s investment practices incorporate all three strategies for principled stewardship outlined by the USCCB guidelines: Avoid Doing Harm, Actively Work for Change, and Promote the Common Good.

Recognized as a leader in faith-consistent investing, Cardinal Peter K.A. Turkson even invited CCF to attend the Third Vatican Conference on Impact Investing .

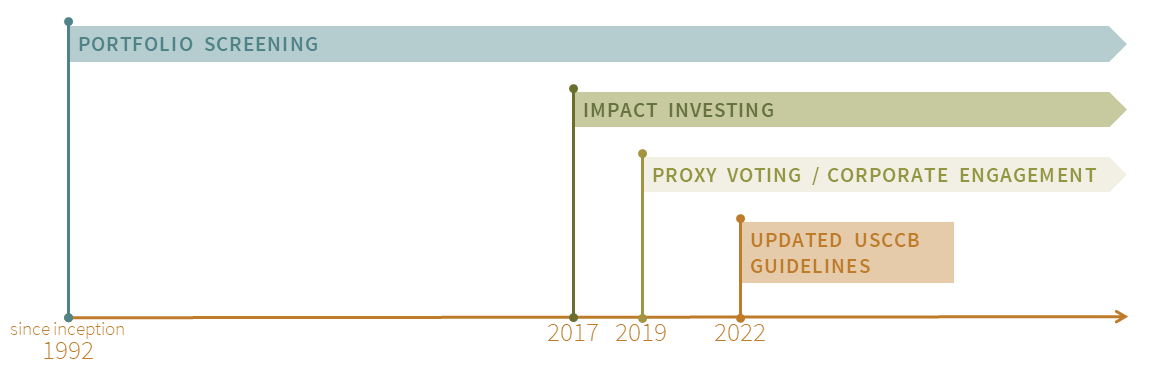

CCF’s Evolution as a Catholic Investor

Avoid Doing Harm

Portfolio Screening

We screen our investment portfolio to ensure we do not hold stock in companies whose activities are contrary to Catholic social teaching. Utilizing the research services of Catholic-based company Investing With Purpose Capital, LLC, we’ve developed a proprietary list of approximately 450 US and foreign companies whose shares we refrain from holding.

Actively Work for Change

Corporate Engagement

We leverage our rights as a shareholder to influence the actions and policies of corporations to bring about positive change and social good. Active corporate participation includes voting proxies, writing letters to executive leadership, and drafting corporate resolutions for shareholder meetings.

Promote the Common Good

Impact Investing

We make impact investments that yield a fiscal return while also generating a social or environmental impact. In simpler terms, impact investments seek to do well financially while also doing good socially. Currently, CCF invests approximately $20 million — or roughly 2% of our portfolio — in impact funds. Those funds include two affordable housing organizations, CommonBond Communities for local projects and Jonathan Rose Companies with projects nationwide, as well as Ascension Investment Management, which manages global impact funds that provide access to medical care in Africa and energy solutions in rural South America.

CCF is also a signatory of the Catholic Impact Investing Collaborative Pledge, which commits Catholic investors to take meaningful and accountable steps to incorporate impact investment into their portfolio in alignment with Catholic social teaching.

CCF is also a signatory of the Catholic Impact Investing Collaborative Pledge, which commits Catholic investors to take meaningful and accountable steps to incorporate impact investment into their portfolio in alignment with Catholic social teaching.Have Questions?

Get in Touch

Michael A. Ricci, Jr., CFP®, CAP®

Investment Officer

651-389-0879

Email Michael