Endowment Fund

A Gift for Today, Tomorrow, and Forever

An endowment is a fund that is invested and provides annual grants to your parish or favorite charity forever. With a permanent endowment, your commitment to the causes you care about can continue beyond your lifetime. When you establish a permanent endowment fund at CCF, you can be assured that we will prudently invest and manage your permanent gift.

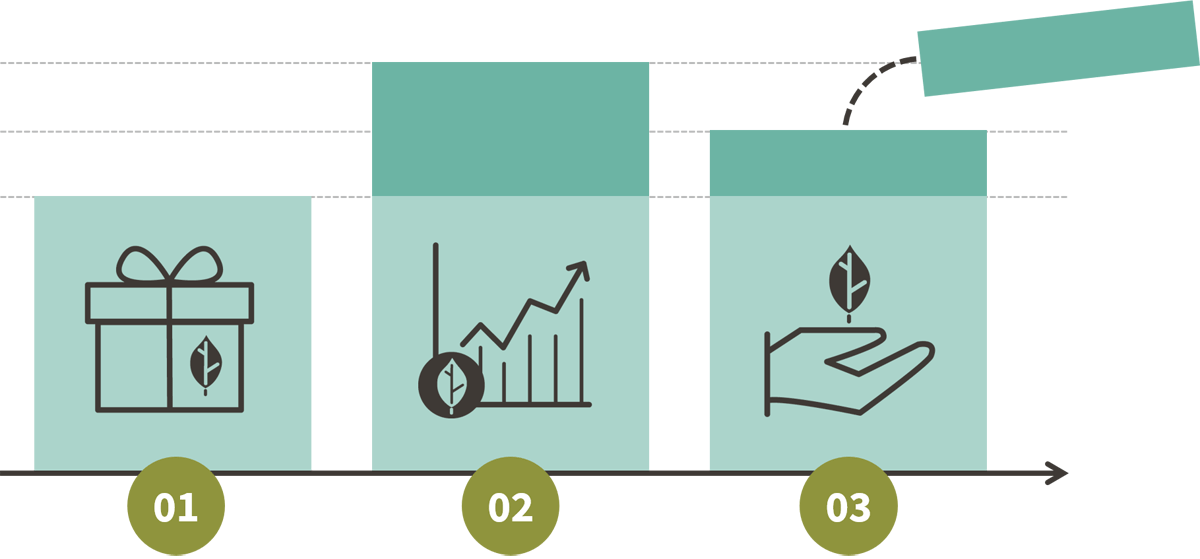

How an Endowment Fund Works

01 Gift

You make a gift to establish the fund. That gift may come in many forms: cash, appreciated stock, real estate, life insurance, or some other asset of value.

Or, you may convert a donor advised fund to a permanent endowment.

02 Invest

CCF strategically invests your fund — in alignment with our Catholic faith — to ensure it weathers market fluctuations and inflation and grows to provide a perpetual source of support to your chosen cause or charity.

03 Grant

Your permanent endowment will make annual distributions to support the charities and/or charitable causes you’ve identified. For example, you could fund: religious education in your parish, tuition assistance, vocations, pro-life causes, etc. You decide.

Other Gift Options

Other gift options for establishing or adding to your endowment include the remainders from charitable trusts and gift annuities that have provided you or a loved one with a lifetime of incremental income.

Different gifts will have different tax and financial benefits for you and your family.

And, once established, your children, grandchildren, or other community members can add to the endowment to honor your legacy. But, CCF will always honor your intent in granting to the causes you care about most – forever.

Get in Touch

We're Happy to Help

Christopher D. Nelson, J.D.

Vice President of Development & Donor Engagement

651-389-0874

Email Christopher

Bethel M. Ruest, MBA

Senior Philanthropic Advisor

651-389-0875

Email Bethel