Invest with CCF

Maximizing Generosity

The investment expertise of the Catholic Community Foundation (CCF) benefits our entire Catholic community. We invest the charitable funds of our donors to maximize their giving to nonprofits. And, we serve as an investment partner to many Catholic parishes, schools, and institutions, providing financial stability for their missions and ministries.

Investment Philosophy

Balanced

Taking a balanced approach, we combine the goals of maximizing financial return and preserving charitable capital with prudent risk tolerance. Our multi-layered oversight structure helps achieve that balance in our every decision.

Faith-Consistent

We view our work as a ministry and strive to infuse Catholic values in all we do — that means investing too. Since our founding, we’ve been thoughtfully evolving as a Catholic investor into the leader we are today.

Transparent

We operate transparently. While past performance is no guarantee of future results, our 990, audited financial statements, and annual report demonstrate our expertise at achieving balance.

Investment Pools and Performance

CCF has built four investment strategies that we call “pools.” These pools offer varying rates of risk and return. By pooling charitable assets under management, CCF is able to optimize performance, drive down costs, and gain access to top investment managers and exclusive asset classes.

- Cash / Short or Intermediate-Term Bonds

- Real Assets / Real Estate or Commodities

- Capital Appreciation / Stocks

- Special Situations / Impact

Short-Term Pool for Preservation

This strategy is designed to keep pace with institutional Money Market funds and the 90-day treasury bill. It is best used to protect principal and preserve charitable capital.

Intermediate-Term Pool for Conservative Growth

This pool aims to minimize volatility and achieve 3 percent over inflation. It is best for those funds seeking to distribute substantial grants in the next 3-5 years.

Long-Term Pool for Balanced Growth

Highly diversified, this pool is designed to provide both growth and income. It is specifically used for endowments and donors with a 7-10-year granting timeline.

Passive Pool for Growth

Holding approximately 80 percent in equities, this more volatile all-index pool may be ideally suited for donors that seek to build charitable capital over 10+ years.

Investment Oversight

MULTI-LAYERED DUE DILIGENCE

Generating investment income is one of CCF’s core functions, but our passion is maximizing returns without compromising core tenets of our shared faith. Our investment oversight process provides checks and balances that ensure compliance with the highest possible standards.

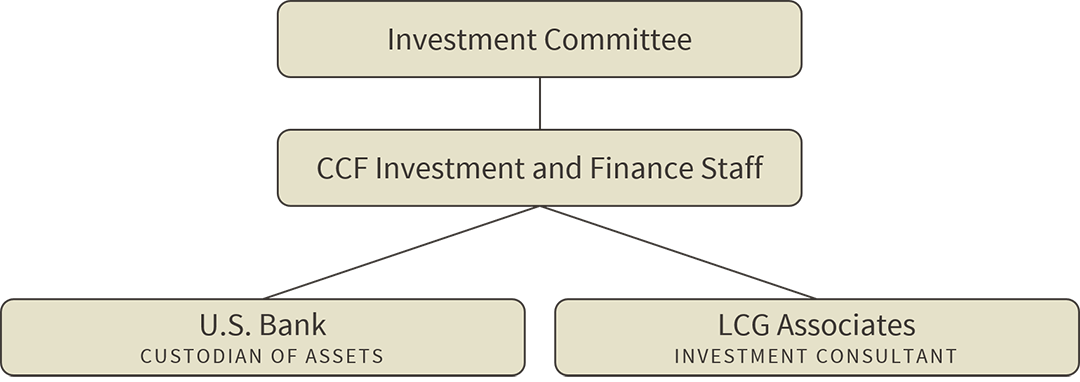

Investment Committee

Strategic Direction

Our investment philosophy is implemented by our Investment Committee which oversees asset allocation and diversification, risk management, investment manager selection, and faith-consistent investing.

CCF Staff

Day-to-Day Operations

CCF finance and investment staff are the interface between the Investment Committee, our Investment Consultants at LCG and U.S. Bank which serves as custodian for all CCF assets.

LCG Associates

Objective Investment Consulting

LCG Associates, Inc. is a full-service investment consulting firm that does not receive “finder’s fees,” commissions, soft dollars, or rebates from any investment management firm. CCF works closely with LCG to implement objective recommendations regarding asset allocation and investment manager selection in order to achieve return objectives and meet our fiduciary duties.

Have Questions?

Get in Touch

Michael A. Ricci, Jr., CFP®, CAP®

Investment Officer

651-389-0879

Email Michael