When the new tax law went into effect, the federal standard deduction nearly doubled. For the vast majority of tax payers, this eliminates the need to itemize deductions. Now, donors and charities alike are wondering whether these tax changes will hinder charitable giving.

Though tax incentives are rarely the only reason for making gifts, bunching has emerged as a strategy to continue giving generously and capture tax savings too.

How Bunching Works

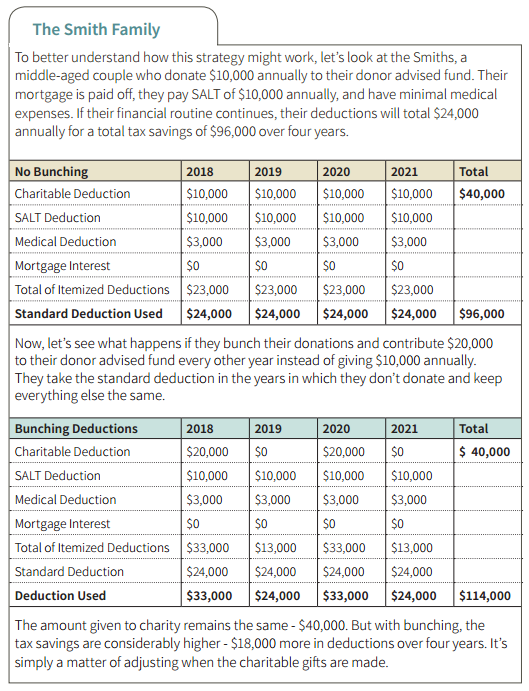

Unless charitable contributions, mortgage interest, medical deductions, and state and local taxes (SALT) combined equal more than $12,000 for individuals or $24,000 for married couples, taxpayers will likely take the new standard deduction.* With a little foresight, donor advisors can make multiple years’ worth of charitable gifts in a single tax year. This allows taxpayers to itemize deductions every other year or every few years, maximizing deductions over time — a strategy known as “bunching.”

“This strategy appeals to people who make annual, ongoing gifts to a number of charities,” says Mary Haeg, senior development officer at the Catholic Community Foundation of Minnesota. “And many do.”

Donor advised funds make this bunching strategy possible. Contributions to a donor advised fund are 100 percent deductible, and grants can be recommended from the fund on the donor’s timeline. With a donor advised fund, donors can “bunch” their charitable gifts, maximize tax savings, and still provide consistent support to their favorite charities.

To learn more, contact Senior Philanthropic Advisor Bethel Ruest.

*For retired taxpayers, the standard deduction is slightly higher. Consult your tax advisor to determine the size of your standard deduction.

We advise you to seek your own legal, tax, and financial advice in connection with gift and planning matters. The Catholic Community Foundation of Minnesota and its staff do not provide legal, tax, or financial advice.