Patrick Murry, CPA, is a partner at Murry & Associates, LLC, where he specializes in assisting individuals and closely-held businesses with their tax planning, preparation, and compliance needs. He serves on the finance council at Holy Name of Jesus in Wayzata. Below, Patrick provides four tips you can use to maximize your charitable investment with a donor advised fund.

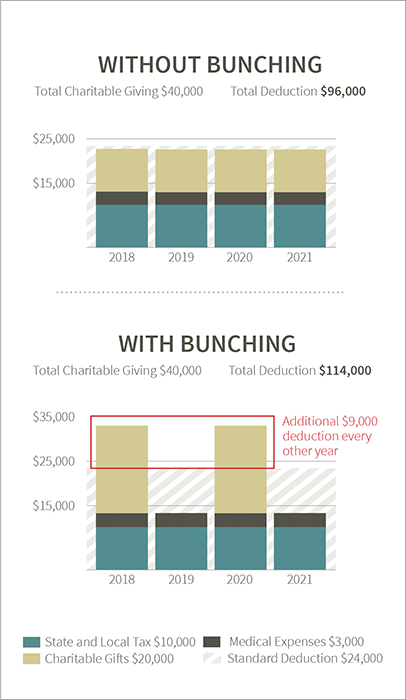

01 Bunch your contributions. The 2017 federal tax law changes raised the standard deduction significantly. Now, many people find that their total itemized deductions fall near or just under the new, higher standard deduction. To maximize your charitable giving and minimize your tax liability, try “bunching.” Here’s how it works: you make an especially large charitable contribution in one year and take the resulting itemized deduction. Then, in subsequent years, make few or no contributions and simply benefit from the higher standard deduction. When you use a donor advised fund to bunch, you can still financially support your favorite nonprofits during the “no contribution” years.

01 Bunch your contributions. The 2017 federal tax law changes raised the standard deduction significantly. Now, many people find that their total itemized deductions fall near or just under the new, higher standard deduction. To maximize your charitable giving and minimize your tax liability, try “bunching.” Here’s how it works: you make an especially large charitable contribution in one year and take the resulting itemized deduction. Then, in subsequent years, make few or no contributions and simply benefit from the higher standard deduction. When you use a donor advised fund to bunch, you can still financially support your favorite nonprofits during the “no contribution” years.

02 Deduct against a single large-income event. Several events can lead to a one-time high-income year, such as selling a business, exercising stock options, or receiving a large commission or year-end bonus. If you know you want to use a portion of the proceeds for charitable purposes but don’t want to do it all immediately, a donor advised fund is a great tool. It allows you to take an immediate tax deduction during your high-income year and direct your donations to specific organizations in future years.

03 Overfund during your high-income years. During your higher-income working years, you can overfund your donor advised fund by making contributions to the fund that are larger than the amount you grant to organizations. Then, during retirement, you have a pool of funds available to continue supporting organizations that are important to you. All along, your investments in the fund continue to grow tax-free.

04 Save on capital gains taxes. Funding your donor advised fund with appreciated assets, like real estate or stock, can provide a tax benefit by saving capital gains taxes that would normally result from the sale of those appreciated assets.

To learn more about donor advised funds, visit ccf-mn.org/giving-options.

We advise you to seek your own legal, tax, and financial advice in connection with gift and planning matters. The Catholic Community Foundation of Minnesota and its staff do not provide legal, tax, or financial advice.