Weeks of bitter cold, heavy snowfall, and canceled meetings didn’t keep 234 individuals from gathering for the Catholic Community Foundation’s (CCF) annual Investment Conference. The event, held on February 13, 2019, convened professional advisors, parish business administrators and trustees, and philanthropists to explore how CCF manages and invests donors’ and parishes’ assets with a Catholic heart.

A variety of speakers delivered updates on the foundation, our investments, and the economic outlook during the two-hour program. These included CCF’s own Anne Cullen Miller and Mike Ricci, Ascension Investment Management (AIM) Chief Investment Officer David Erickson, and economic commentator Jim Paulsen.

8 Highlights from the Investment Conference (in your words):

01 “Jim Paulsen’s update is always a highlight!” At last year’s conference, Jim Paulsen predicted markets were heading for a correction in 2018 – and he was correct. This year, Paulsen predicts a potential economic slowdown, followed by a likely return to optimism.

02 “The networking opportunity” and “free breakfast.” The chance to share a (free!) meal with other brilliant and like-minded professionals is part of what makes the Investment Conference so popular year after year.

03 “Information on impact investing.” According to AIM’s David Erickson, impact investments are designed to generate a beneficial social and/or environmental impact while seeking to realize a financial return. Some of the projects in which CCF invests, through AIM, include:

- Replacing diesel generators in Sub-Saharan Africa with a solar-diesel-battery hybrid system. The system provides a more reliable electricity source to its customers, while significantly reducing greenhouse gas emissions.

- Building pharmacies in East Africa that will provide high-quality, affordable drugs and medical services to underserved households.

- A financial services fund that serves emerging markets to provide small business loans.

04 “The deep dive on CCF’s four functions.” CCF president Anne Cullen Miller explained how CCF works through a simple four-step cycle.

05 “Commitment to Catholic principles.” CCF’s Catholic investing continues to evolve. We’ve been screening our investment portfolio since we began in 1992. In 2017, we began impact investing (learn more here). Now, we are focusing on leveraging our power as a shareholder to influence corporate decision-making through proxy voting and corporate engagement.

06 “The CCF portfolio review.” Investment managers from LCG highlighted how a volatile fourth-quarter market netted negative returns for 2018 in nearly all asset classes. But, CCF pools performed better than benchmark! The intermediate-term pool for conservative growth and long-term pool for balanced growth both outperformed their benchmarks.

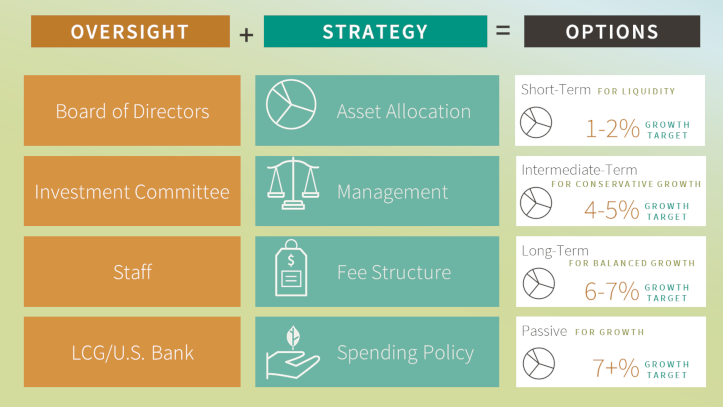

07 “I have a much better understanding of how CCF works.” CCF’s director of professional outreach and investments Mike Ricci outlined the simple formula CCF follows to prudently manage $340 million in assets.

08 “Very professional. Very informative. Very straightforward.” The program lasted only two hours, but it was full of valuable information for investors, parish finance councils, and individual donors alike.

To view more photos from the 2019 Investment Conference, click here. And stay tuned for details about next year’s Investment Conference. We hope to see you there.