Who We Are

Joyful Stewards of Catholic Giving

The Catholic Community Foundation stewards the financial resources of Catholic individuals, families, parishes, and institutions. We help Catholics know the joy that comes from expressing faith through giving.

Together, with our donors and partners, we hold an unshakable belief in the future of a thriving Catholic community.

Our Mission

Sacred and Communal

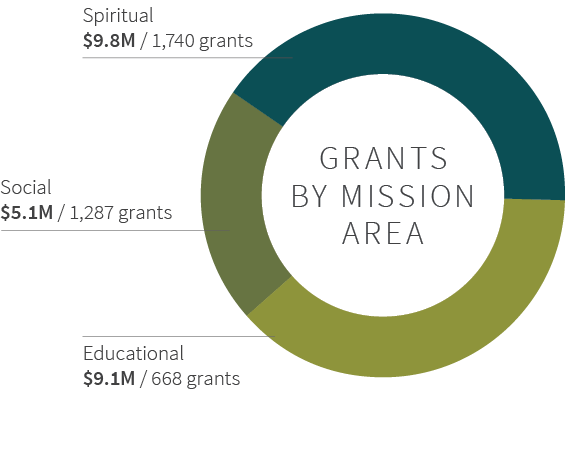

To support financially the spiritual, educational, and social needs of our Catholic community.

We believe our mission is sacred. It’s a faithful, generous response to the many blessings we’ve received. Through our mission, we invite our Catholic community to walk spiritual ground, doing service that’s profound, compassionate, and perpetual.

Our Impact

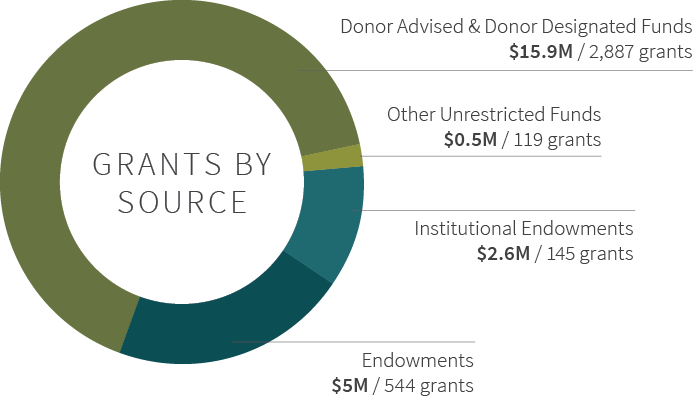

FUELING VITAL MISSIONS AND MINISTRIES

When you give through the Catholic Community Foundation, your generosity is invested and yields grants that help build and sustain a vibrant Catholic community.

FISCAL YEAR ENDING JUNE 30, 2023

Working With the CCF Team

Working Together For Good

FAQs

What is a community foundation?

A community foundation is a public charity established to serve specific charitable interests in a designated geographical region. The Catholic Community Foundation of Minnesota serves the spiritual, educational and social needs of our community — in accordance with Catholic faith.

What's the difference between Catholic Charities and CCF?

The Catholic Community Foundation collects, grows, and distributes funds on behalf of our donors. Their gifts and The Legacy Fund sustain many of the programs provided by Catholic Charities and many other nonprofit organizations. We provide targeted financial support that enables those organizations to serve the spiritual, educational, and social needs of the community in perpetuity.

Why not just give directly to a charity?

We never discourage charitable giving — and there are many organizations that need funds right now. Our donors often are in a position to give to an organization today while also growing funds to support that organization’s work in perpetuity.

For example, directing grants from donor advised funds can help struggling parishes keep their schools open today. Legacy giving can help those same parishes educate the students of tomorrow.

Can I only donate to Catholic organizations?

Donors can make grants to any organization that serves the spiritual, educational, and social needs of the community — and does not engage in activity contrary to Catholic teachings.

For example, the United Jewish Fund, Augsburg College, and the Guthrie Theater Foundation are among the many non-Catholic organizations that have received grants through CCF.

Our dedicated staff uses nonprofit evaluation resources, such as Guidestar, to help donors research organizations they’d like to support. Donors can be confident that any nonprofits receiving funds through CCF are:

- Defined as tax-exempt under Section 501(c)(3) of the Internal Revenue Service code.

- Financially viable.

- Have missions, values, and behaviors that don’t conflict with Catholic teachings.

Is there a minimum amount to get started?

It depends on the giving option you choose.

If you’re contributing to an existing fund, there is no minimum. You can set up a donor advised fund for $10,000.

Contact CCF at 651-389-0300 to explore your planned giving options.

Are there costs associated with establishing a donor advised fund?

There are no upfront, out-of-pocket expenses.

CCF is responsible for investing the assets you contribute. An annual administration fee of the greater of $250 or 1% of the value of the fund is charged against the balance of your fund. An additional investment management fee is charged that is subject to change and ranges between approximately 0.2% - 0.8% of the value of the fund.

Those two fees provide the funds necessary to keep our doors open and staff working on your behalf.

There are capital gains tax savings and estate planning benefits that often offset this fee.

What are the tax benefits of giving through CCF?

The Catholic Community Foundation cannot serve as your tax, legal, or financial advisor — but we can speak knowledgeably with you and your advisors and provide all the documentation you need to take full advantage of the tax benefits of charitable giving.

Tax benefits are not the primary reason most donors choose to work with CCF, but our assistance in helping you weigh the tax benefits of various funds is invaluable.

Once they see the tax savings associated with charitable giving, many donors are pleased to discover they can contribute more than they had initially planned.

GIVING CASH: You may deduct the full amount of your gift in the gifting year to offset up to 60% of your adjusted gross income (AGI). If your total giving in a single year exceeds 60% of your AGI, you can carry any excess deduction forward for an additional five-year period after the year of contribution.

GIVING APPRECIATED SECURITIES: Gifts of long-term appreciated securities, or stock (i.e., securities that you have owned for more than one year), are deductible for the full fair market value on the date of the gift. You do not pay capital gains taxes on the appreciated portion of your gift.

With a gift of securities, you may deduct the full amount of your gift in the gifting year to offset up to 30% of your adjusted gross income (AGI). If your gift exceeds 30% of your AGI, you can carry any excess deduction forward and deduct up to the 30% limit in the five-year period after the year of contribution.