Charitable Remainder Trust

A Tool For Tax, Estate, and Charitable Planning

A charitable remainder trust (CRT) is an attractive giving option for donors with highly appreciated assets, particularly stock or real estate. A CRT provides annual payments to beneficiaries, either until their death or for a term of years. Then, everything that remains in the trust is donated to charity.

How a Charitable Remainder Trust Works

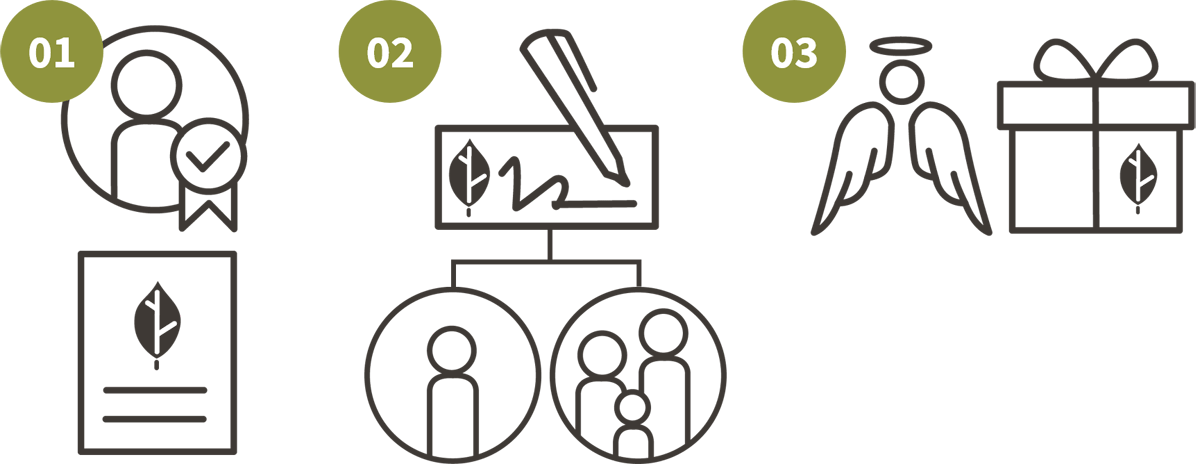

(01) You work with your attorney to draft the trust, select beneficiaries, and make an irrevocable donation of assets. You’ll receive an immediate partial tax deduction at this time. And, you’ll skip paying capital gains taxes on the assets donated to the trust.

Then, (02) you and your beneficiaries will receive fixed payments from the trust each year for the remainder of your life or for a set term.

(03) Upon the death of the final beneficiary – or at the end of the set term – the remainder of the trust is donated to charity.

Due to the initial cost of drafting a charitable remainder trust, it’s best suited for gifts of $100,000 or more. But, when considering what to do with appreciated assets such as real estate, an IRA, or shares in a business, a charitable remainder trust can be a great tool for tax, estate, and charitable planning all at once.

View associated fees here.

Get in Touch

We're Happy to Help

Christopher D. Nelson, J.D.

Vice President of Development & Donor Engagement

651-389-0874

Email Christopher

Bethel M. Ruest, MBA

Senior Philanthropic Advisor

651-389-0875

Email Bethel